4 Consequences of Unfiled Tax Returns

Negligence or inability to file a tax return, when you owe the IRS is an invitation to trouble. Many taxpayers are unaware of the fact that an unfiled tax return is worse than filing a return and not paying the due amount. If you are unable to pay your taxes, the IRS has avenues to […]

How I Settled a $140,000 IRS Tax Liability For $3,000

Yes, it’s actually true, this happened yesterday, so I decided to change my topic and go through this with you. So this client came to me in 2016. She had owned a day care center and starting in 2010 she came into financial distress. Her husband worked in real estate and was over leveraged and […]

Need Help With IRS Tax Problems? 4 Solutions That Can Help You!

Respond to Notices in a Timely Fashion Don’t ignore notices you receive in the mail! If a taxpayer receives a notice from the IRS, make sure to to respond before the deadline. Keep a copy and proof of mailing, preferably a certified mail receipt to verify mailing and IRS receipt. Taxpayers should explain themselves thoroughly, […]

Four Ways to Get $10,000 or More of IRS Tax Debt Reduced

According to the IRS, more than 13.2 million Americans owe back taxes. The majority of these cases involve amounts that seem impossible to pay off. Often times, though, there are ways to get your IRS liability reduced but unfortunately most taxpayers are unaware of these methods. Below are four ways you can get your IRS debt […]

Why Early Adopters of Cryptocurrency Should Explore Their Tax Resolution Options Now

The stunning rise in the value of Bitcoin, along with the myriad of cryptocurrencies, is surely one of the biggest financial stories of the 21st century, at least so far. What started out as a mere curiosity and niche project for programmers and geeks has quickly blossomed into a full-fledged financial asset, and an increasingly […]

Do You Owe Money to the IRS? Possible Tax Resolution Strategies to Set Your Mind at Ease

Even for honest taxpayers, the IRS can be extremely frightening. Unlike most other government agencies, the IRS has the power to attach your wages, freeze your bank account and even confiscate your property, and that is enough to send a chill up the spine of any taxpayer. If you receive a letter from the IRS […]

Why This Should Be The Year You Pay Off Back Taxes

According to the IRS, more than 13.2 million Americans owe back taxes. The majority of these cases involve amounts that seem impossible to pay off. That leaves those tax-owing Americans in a difficult position. They want to pay, but they can’t, and the end result is feeling a lot of guilt about the situation. There […]

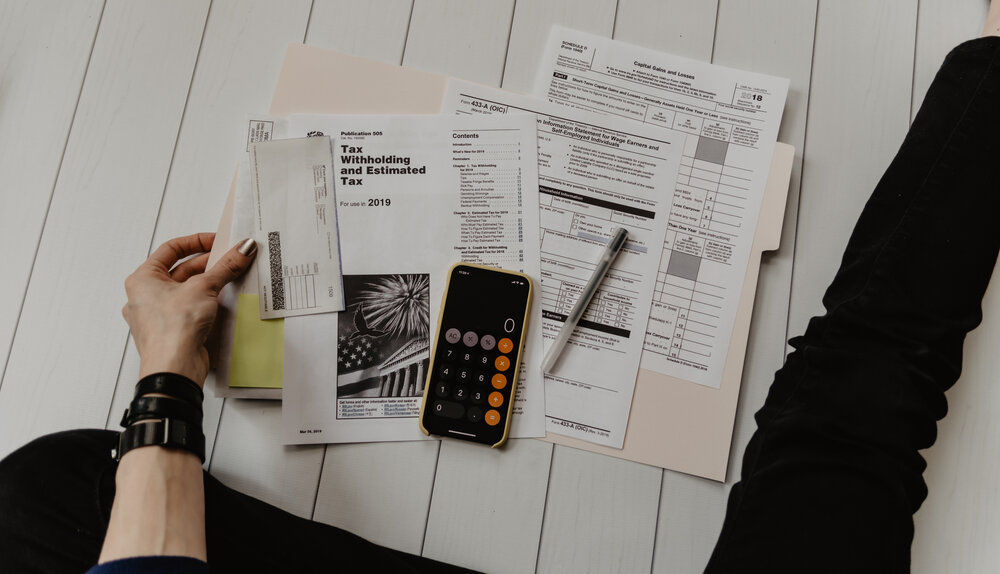

When You Can’t Afford to Pay Your Tax Debt: Tax Resolution with an Offer in Compromise

An offer in compromise (OIC) is the IRS’ tax resolution debt settlement program. It’s a program for taxpayers who owe the Internal Revenue Service more money than they can afford to pay. Sometimes referred to as the IRS’s “fresh start” program, if approved the IRS accepts a lesser amount (sometimes a fraction of what’s owed) […]

How to Avoid The New Potential Jersey City Payroll Tax

With the recent vote by city council and verbal support from the Mayor, it seems inevitable that Jersey City will passing a 1% payroll tax on all businesses, regardless of size. How To Avoid The Tax 1. Hire Jersey City residents. All employees that reside in Jersey City are exempt from the tax, further incentivizing businesses to […]

New Jersey’s New Paid-Sick-Leave Law: What You Need to Know

Are you a New Jersey based business owner with employees? Beginning Oct. 29th, the New Jersey Paid Sick Leave Act will require New Jersey employers of ALL sizes to provide up to 40 hours of paid sick leave per year to covered employees. Who is considered a Covered Employee?The act applies to most employees working […]